Zatca

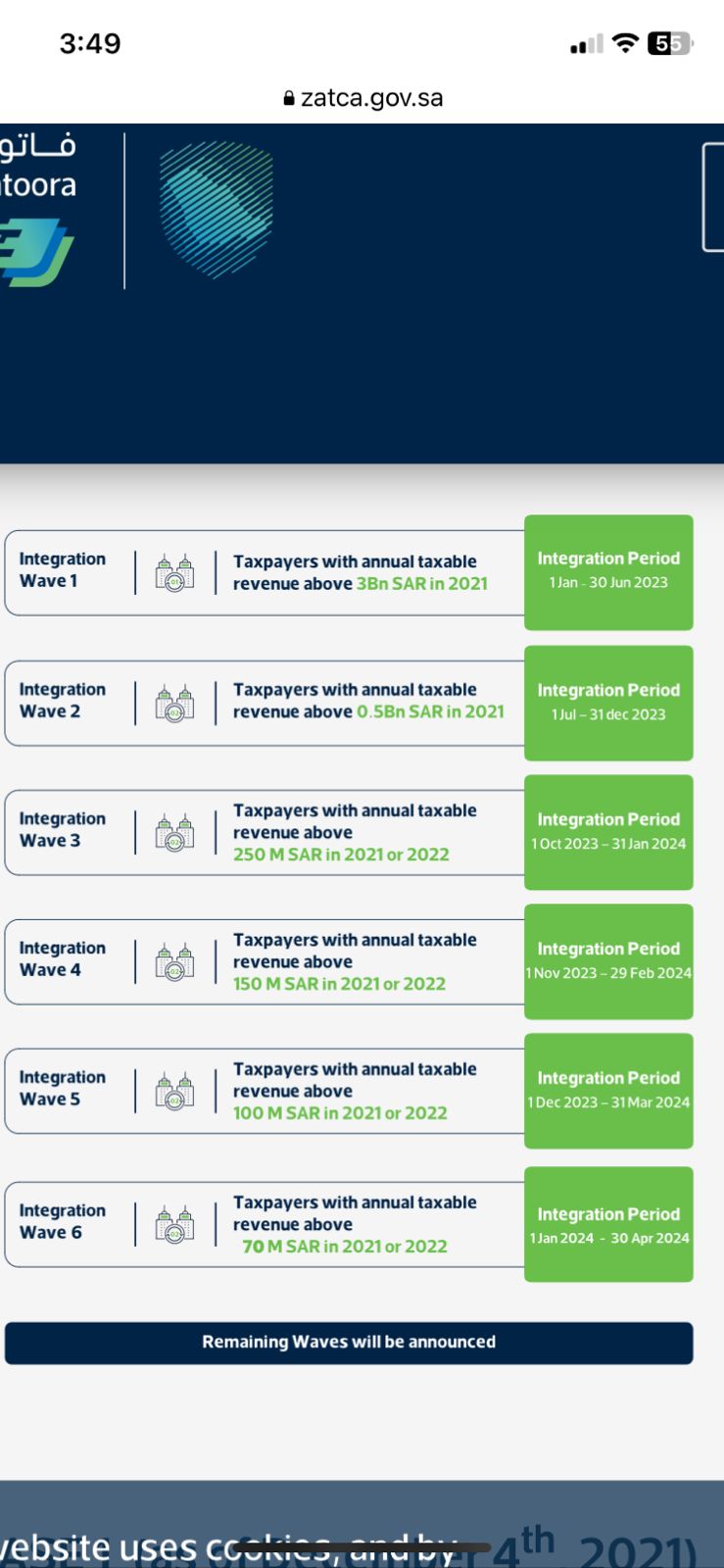

Audience: This blog is intended to explain the ZATCA’s Phase-2 E-Invoicing process to a Taxpayer/EGS user in Saudi Arabia. So, I will address the “Taxpayer” as “you” throughout this blog. Overview: With successful ZATCA Phase-1 E-Invoicing rolled out on 4 December 2021, Phase-2 is commencing in waves by January 1, 2022. Phase-2 E-Invoicing is also called the integration phase. The compliant EGS purchased by you in Phase-1 should now be integrated with ZATCA through the Fatoora Portal for reporting/clearance of invoices/notes. The integration process aims to automatically share the tax documents with ZATCA throughout the Financial year. ZATCA has published the detailed integration procedure for Phase-2 which involves several steps that should be completed by the given deadline. ZATCA portal will notify you 6 months prior time for the integration process being completed. EGS Onboarding in simple terms is registering your EGS unit(s) on the Fatoora Portal with the TIN and identifier details about the EGS unit. On successful completion of the onboarding process, you’ll receive a production CSID(Cryptographic Stamp Identifier). For CSR request you need this information required EGS Serial Number: If we get on boarding successful , you can generate qr code for B2B standard invoices, customer will receive print QR code that will be signed from zatca, its status: cleared the other invoice type simplified you report the data to zatca within 24 hours for B2C invoices , reporting status: reported as you got CSID, now you have to perform test invoices, then check on button PCSID after that you can see your device listed on zatca simulation portal The FSP portal can be accessed via a dedicated tile on the Fatoora portal for taxpayers. It is to be noted that the FSP is not intended for generating actual invoices. Instead, it should be used for testing with dummy or historical data. Hence the response in the FSP shouldn't be considered as an official clearance or reporting of the documents by ZATCA. Odoo Database Set-up Apps to install https://apps.odoo.com/apps/modules/16.0/ksa_zatca_integration/ Company set up on Simulation portal Company Information: From the settings, update the following company information: Fill the customers/vendors contact information following the steps below: Testing about qr code, it has 5 values from phase 1 but extra information below added too https://zatca.gov.sa/en/E-Invoicing/Introduction/Pages/Roll-out-phases.aspx https://login.gazt.gov.sa https://zatca.gov.sa/en/E-Invoicing/Introduction/Guidelines/Documents/Fatoora_Portal_User_Manual_English.pdf https://gw-fatoora.zatca.gov.sa/e-invoicing/developer-portal https://gw-fatoora.zatca.gov.sa/e-invoicing/simulation https://gw-fatoora.zatca.gov.sa/e-invoicing/core https://zatca.gov.sa/ar/E-Invoicing/Introduction/Guidelines/Documents/E-invoicing Detailed Technical Guidelines.pdf https://zatca.gov.sa/ar/E-Invoicing/SystemsDevelopers/Documents/20230519_EInvoice_Data_Dictionary vF.xlsxEGS Onboarding — ZATCA Phase-2 E-Invoicing

Abbreviations used:

Integration procedure:

Let’s discuss the Onboarding process in detail:

Examples:

Steps for onboarding the EGS unit with the Fatoora Portal:

Testing our application with zatca odoo side , its important

Contacts:

Should have button for click on regenerate CSR if face any issue at any state.Fatoora Phases/Waves information Link

Fatoora Portal Login link

Fatoora Portal Document link

Developer portal/sandbox api link

simulation portal api link

Live Production api link

Fatoora Technical Details Document link

Security Feature Document link

Data Dictionary Document link